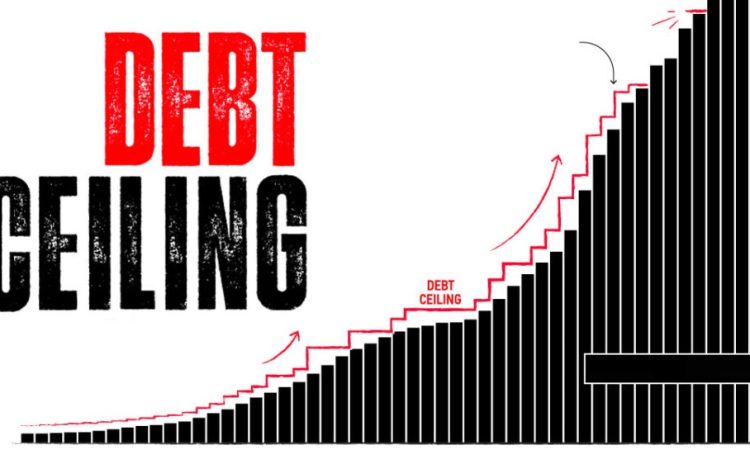

Debt ceiling crises can have widespread effects across the U.S. economy, but certain sectors are particularly vulnerable due to their reliance on government funding, stability, or consumer confidence. Here’s a closer look at the economic sectors most impacted by debt ceiling standoffs and potential defaults. Let’s look at the thoughts of respected experts like Kavan Choksi.

- Defense and Government Contracting

The defense industry is heavily dependent on government contracts, making it especially sensitive to debt ceiling debates.

- Delayed Payments:

- Contractors may face delays in receiving payments for ongoing projects, affecting cash flow and operations.

- Project Halts:

- Prolonged uncertainty can lead to a slowdown or suspension of major defense projects.

- Impact on Workforce:

- Companies may furlough workers or postpone hiring due to budget freezes.

Example: During the 2013 debt ceiling crisis, defense contractors reported delays in project approvals and payments.

- Healthcare and Social Services

Healthcare providers and programs reliant on government funding are at risk during a debt ceiling crisis:

- Medicare and Medicaid:

- Delayed reimbursements to hospitals and healthcare providers could strain their financial stability.

- Veterans’ Services:

- Services provided by the Department of Veterans Affairs (VA) may be reduced or delayed.

- Public Health Programs:

- Funding for programs like the CDC and NIH could face disruptions, affecting research and public health initiatives.

Impact: Vulnerable populations relying on government-supported healthcare programs may experience reduced access to essential services.

- Financial Services and Banking

The financial sector is highly sensitive to debt ceiling crises due to market volatility and credit concerns:

- Treasury Bond Market:

- U.S. Treasury bonds are a cornerstone of financial markets. A default or uncertainty surrounding payments could destabilize the bond market.

- Interest Rates:

- Rising interest rates due to perceived risks can increase borrowing costs for banks and consumers alike.

- Global Confidence:

- Financial institutions with significant holdings in U.S. Treasury bonds may face losses, affecting global credit markets.

Example: In 2011, debt ceiling debates led to a credit rating downgrade, resulting in increased market volatility and higher borrowing costs.

- Small Businesses

Small businesses, which often depend on stable consumer demand and affordable credit, are indirectly affected:

- Reduced Consumer Spending:

- Economic uncertainty causes consumers to cut back on discretionary spending, affecting retail and service-oriented small businesses.

- Limited Access to Loans:

- Rising interest rates and tighter credit conditions make it harder for small businesses to secure financing.

- Delayed Government Payments:

- Businesses contracting with the federal government may face delays in payment, disrupting cash flow.

Impact: Prolonged uncertainty can lead to closures or reduced operations for small enterprises.

- Global Trade and Foreign Investment

Global markets closely tied to the U.S. economy also feel the ripple effects of debt ceiling crises:

- Export-Oriented Industries:

- A weaker dollar or reduced economic activity in the U.S. can lower demand for imported goods and services.

- Foreign Investments in Treasuries:

- Countries like China and Japan, major holders of U.S. debt, may reassess their investments, destabilizing global markets.

- Trade Partners:

- Economic uncertainty in the U.S. can disrupt supply chains and trade agreements, particularly for countries heavily reliant on U.S. imports.

Example: During the 2013 crisis, global investors expressed concern over the reliability of the U.S. as a stable economic partner.

Conclusion

Debt ceiling crises disproportionately impact sectors like defense, healthcare, financial services, and small businesses, as well as global trade networks. The ripple effects of delayed payments, rising interest rates, and economic uncertainty highlight the importance of timely resolutions to debt ceiling debates. These sectors’ vulnerability underscores the broader economic risks associated with political impasses over government borrowing limits.